Circuit Breaker Tax Credit In Massachusetts . Homeowners only, enter assessed value of. What is the senior circuit breaker tax credit? if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts state income tax return. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. senior circuit breaker tax credit. Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. This increase will make it easier for. senior circuit breaker tax credit. What are the income limits for 2021? Who is eligible for this credit? refundable state tax credit against property taxes for seniors (circuit breaker) seniors are eligible for a tax credit to the extent that. to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—.

from www.pdffiller.com

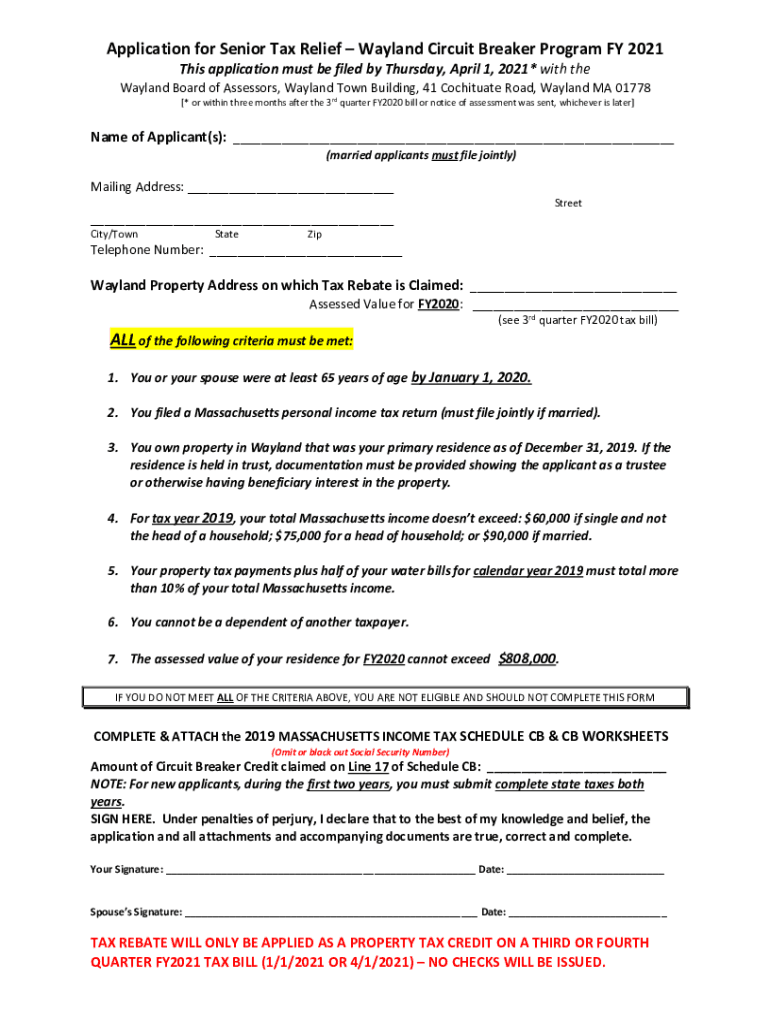

Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. senior circuit breaker tax credit. Homeowners only, enter assessed value of. What is the senior circuit breaker tax credit? if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts state income tax return. senior circuit breaker tax credit. Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. This increase will make it easier for. Who is eligible for this credit?

Fillable Online Massachusetts Senior Circuit Breaker Tax Credit Mass

Circuit Breaker Tax Credit In Massachusetts refundable state tax credit against property taxes for seniors (circuit breaker) seniors are eligible for a tax credit to the extent that. to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. senior circuit breaker tax credit. This increase will make it easier for. Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts state income tax return. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. Homeowners only, enter assessed value of. refundable state tax credit against property taxes for seniors (circuit breaker) seniors are eligible for a tax credit to the extent that. Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. What are the income limits for 2021? senior circuit breaker tax credit. What is the senior circuit breaker tax credit? Who is eligible for this credit?

From lifepathma.org

Do You Qualify for the Senior Circuit Breaker Tax Credit? LifePath Circuit Breaker Tax Credit In Massachusetts This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. What is the senior circuit breaker tax credit? to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. This increase will. Circuit Breaker Tax Credit In Massachusetts.

From vimeo.com

Headspace Massachusetts Senior "Circuit Breaker" Tax Credit on Vimeo Circuit Breaker Tax Credit In Massachusetts if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts state income tax return. Homeowners only, enter assessed value of. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. What are the income limits for 2021? Who is. Circuit Breaker Tax Credit In Massachusetts.

From www.templateroller.com

Schedule CB Download Printable PDF or Fill Online Circuit Breaker Circuit Breaker Tax Credit In Massachusetts This increase will make it easier for. senior circuit breaker tax credit. Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. Homeowners only, enter assessed value of. Doubles. Circuit Breaker Tax Credit In Massachusetts.

From itep.org

Circuit Breakers and Other Property Tax Programs in 2023 Circuit Breaker Tax Credit In Massachusetts What are the income limits for 2021? What is the senior circuit breaker tax credit? Homeowners only, enter assessed value of. refundable state tax credit against property taxes for seniors (circuit breaker) seniors are eligible for a tax credit to the extent that. if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts. Circuit Breaker Tax Credit In Massachusetts.

From www.pdffiller.com

Fillable Online Senior Circuit Breaker Tax Credit Mass.gov Fax Email Circuit Breaker Tax Credit In Massachusetts to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. This increase will make it easier for. Homeowners only, enter assessed. Circuit Breaker Tax Credit In Massachusetts.

From patch.com

Rep. Jones Circuit Breaker Offers Tax Savings For Qualifying Seniors Circuit Breaker Tax Credit In Massachusetts if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts state income tax return. senior circuit breaker tax credit. Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. What is the senior circuit breaker tax credit? This increase will make it easier for. to claim. Circuit Breaker Tax Credit In Massachusetts.

From www.zrivo.com

Massachusetts Circuit Breaker Tax Credit 2024 Circuit Breaker Tax Credit In Massachusetts Homeowners only, enter assessed value of. What is the senior circuit breaker tax credit? This increase will make it easier for. Who is eligible for this credit? Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. senior circuit breaker tax credit. refundable state tax credit against property taxes for seniors (circuit breaker) seniors are eligible for. Circuit Breaker Tax Credit In Massachusetts.

From worthtax.com

Massachusetts Circuit Breaker Tax Credit Circuit Breaker Tax Credit In Massachusetts to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. What are the income limits for 2021? Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. Who is. Circuit Breaker Tax Credit In Massachusetts.

From www.youtube.com

Senior Center Presents Circuit Breaker Tax Credit 2021 YouTube Circuit Breaker Tax Credit In Massachusetts Homeowners only, enter assessed value of. Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. senior circuit breaker tax credit. if you are eligible for the circuit breaker credit, complete schedule. Circuit Breaker Tax Credit In Massachusetts.

From www.youtube.com

Circuit Breaker 2020 Tax Credit for Seniors Citizens YouTube Circuit Breaker Tax Credit In Massachusetts Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. Who is eligible for this credit? senior circuit breaker tax credit. This increase will make it easier for. What is the senior circuit. Circuit Breaker Tax Credit In Massachusetts.

From repmindydomb.com

MASSACHUSETTS SENIOR CIRCUIT BREAKER TAX CREDIT Circuit Breaker Tax Credit In Massachusetts senior circuit breaker tax credit. senior circuit breaker tax credit. Homeowners only, enter assessed value of. to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. This increase will make it easier for. This tax credit is specifically designed for individuals aged 65 and. Circuit Breaker Tax Credit In Massachusetts.

From worthtax.com

Massachusetts Circuit Breaker Tax Credit Circuit Breaker Tax Credit In Massachusetts senior circuit breaker tax credit. Who is eligible for this credit? Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. if you are eligible for the circuit breaker credit, complete schedule cb with your massachusetts state income tax return. What is the senior circuit breaker tax credit? refundable state tax. Circuit Breaker Tax Credit In Massachusetts.

From patch.com

Senior Circuit Breaker Tax Credit Presentation Tuesday Wakefield, MA Circuit Breaker Tax Credit In Massachusetts senior circuit breaker tax credit. What is the senior circuit breaker tax credit? Homeowners only, enter assessed value of. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. if you are eligible for the circuit breaker credit, complete schedule cb with your. Circuit Breaker Tax Credit In Massachusetts.

From www.senatormikemoore.com

Senator Mike Moore Senior Circuit Breaker Circuit Breaker Tax Credit In Massachusetts to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. senior circuit breaker tax credit. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential property. senior circuit breaker tax. Circuit Breaker Tax Credit In Massachusetts.

From itep.org

Preventing an Overload How Property Tax Circuit Breakers Promote Circuit Breaker Tax Credit In Massachusetts What is the senior circuit breaker tax credit? Homeowners only, enter assessed value of. refundable state tax credit against property taxes for seniors (circuit breaker) seniors are eligible for a tax credit to the extent that. senior circuit breaker tax credit. This increase will make it easier for. to claim the circuit breaker credit, you must file. Circuit Breaker Tax Credit In Massachusetts.

From www.linkedin.com

A break for seniors in MA the Circuit Breaker Tax Credit Circuit Breaker Tax Credit In Massachusetts Senior citizens in massachusetts have the opportunity to benefit from the senior circuit breaker tax credit. What are the income limits for 2021? senior circuit breaker tax credit. Who is eligible for this credit? This increase will make it easier for. Doubles the maximum senior circuit breaker credit from $1,200 to $2,400. What is the senior circuit breaker tax. Circuit Breaker Tax Credit In Massachusetts.

From www.pdffiller.com

Fillable Online Massachusetts Senior Circuit Breaker Tax Credit Mass Circuit Breaker Tax Credit In Massachusetts senior circuit breaker tax credit. to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. Homeowners only, enter assessed value of. This tax credit is specifically designed for individuals aged 65 and older, providing them with relief from massachusetts real estate taxes on their residential. Circuit Breaker Tax Credit In Massachusetts.

From patch.com

Andover Offering Tax Exemption For Eligible Seniors Andover, MA Patch Circuit Breaker Tax Credit In Massachusetts This increase will make it easier for. What are the income limits for 2021? Homeowners only, enter assessed value of. to claim the circuit breaker credit, you must file a massachusetts state income tax return, even if you typically don’t file a return—. senior circuit breaker tax credit. refundable state tax credit against property taxes for seniors. Circuit Breaker Tax Credit In Massachusetts.